Automated reconciliation software is revolutionizing the way businesses manage their financial records by automating the process of comparing internal records with external statements. This technology significantly reduces the time and effort involved in manual reconciliation, enhances accuracy, and provides real-time financial insights. Here’s an in-depth look at the benefits, features, and applications of automated reconciliation software.

Key Features and Benefits

- Efficiency and Time Savings: Automated reconciliation software dramatically decreases the time required to match transactions. By automatically importing data from various sources and comparing it with internal records, the software quickly identifies discrepancies. This efficiency allows finance teams to focus on more strategic activities rather than spending hours on manual reconciliation.

- Enhanced Accuracy: Manual reconciliation is susceptible to human errors, which can lead to financial discrepancies. Automated reconciliation software employs sophisticated algorithms to ensure precise matching of transactions, significantly reducing errors and ensuring that financial records are accurate and reliable.

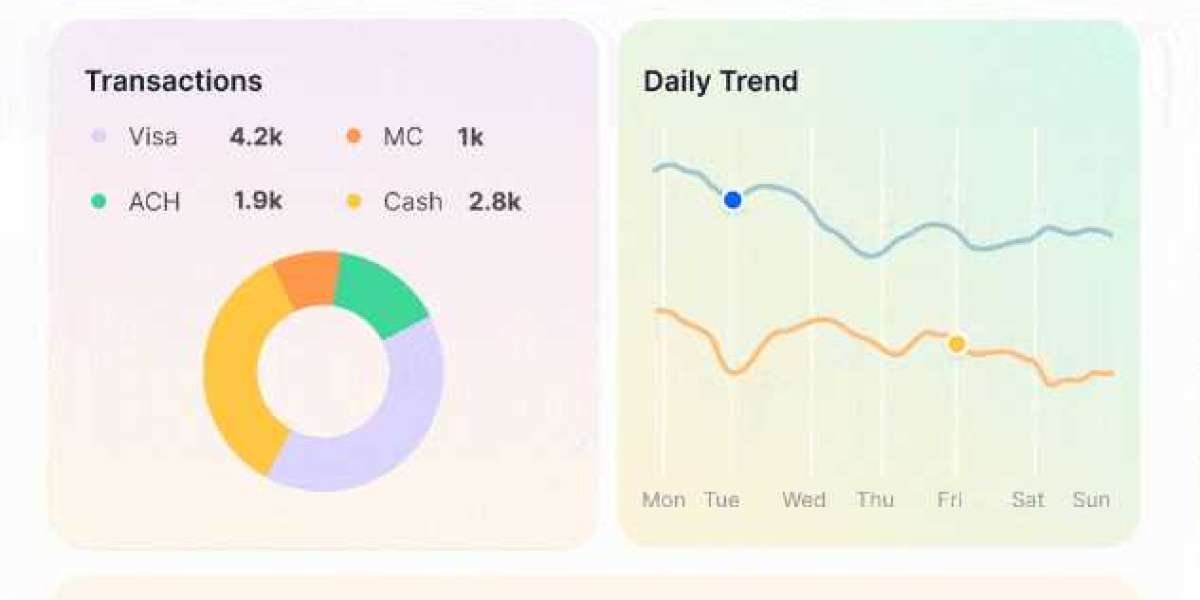

- Real-Time Processing: The software provides real-time processing capabilities, offering up-to-date financial information. This feature is particularly beneficial for businesses with high transaction volumes, enabling continuous monitoring and maintenance of accurate financial records.

- Improved Fraud Detection: Automated reconciliation software continuously monitors transactions for unusual patterns or discrepancies, helping to identify potential fraudulent activities. This proactive approach enhances financial security and protects businesses from potential losses.

- Seamless Integration: Modern reconciliation software integrates seamlessly with existing accounting and enterprise resource planning (ERP) systems. This integration ensures a smooth flow of financial data across different platforms, enhancing overall financial management and reporting.

- Customizable Matching Rules: Businesses can configure the software to match transactions based on specific criteria such as amount, date, or transaction type. This customization allows for a tailored reconciliation process that aligns with the unique needs and policies of the business.

- Comprehensive Reporting and Audit Trails: The software provides detailed reports that offer insights into the reconciliation process, including unmatched transactions and overall reconciliation status. Additionally, it maintains thorough audit trails, documenting every transaction and reconciliation activity for compliance and future reference.

Applications Across Industries

Automated reconciliation software is versatile and beneficial across various industries:

- Retail and E-commerce: Businesses with high transaction volumes benefit from the efficiency and accuracy of automated reconciliation. The software helps manage and reconcile sales, refunds, and payments seamlessly.

- Banking and Financial Services: Financial institutions use automated reconciliation to handle large volumes of transactions, ensuring compliance with regulatory standards and enhancing financial reporting accuracy.

- Manufacturing: Automated reconciliation supports the accurate tracking and reconciliation of supplier invoices, payments, and financial records, enhancing financial management in the manufacturing sector.

- Healthcare: In the healthcare industry, automated reconciliation helps manage and reconcile patient billing, insurance claims, and payments, ensuring financial accuracy and regulatory compliance.

- Nonprofit Organizations: Nonprofits benefit from automated reconciliation by improving cash management, enhancing financial reporting, and ensuring that funds are used effectively to support their missions.

Conclusion

Automated reconciliation software is a transformative tool for businesses aiming to improve financial accuracy, efficiency, and security. By automating the reconciliation process, companies can minimize errors, save time, and gain real-time insights into their financial health. As the financial landscape becomes increasingly complex, the role of automated reconciliation software in supporting robust financial management and strategic decision-making is crucial. Embracing this technology not only enhances operational efficiency but also strengthens overall financial integrity and performance.

For more info; visit us:

Addressing the Talent Gap: Upskilling Finance Professionals for the Age of Automation